You know that your credit and debit cards include all sorts of loyalty programs and special discounts when you shop at select stores or restaurants. But did you actually read through those documents that come from the bank, to figure out where the best deals are? And even if you did that, unless you go out specially to take advantage of a scheme, will you remember all the deals the next time you go shopping?

If you carry two or three cards in your wallet then do you know which one you should be using when you’re making a purchase? Or do you just pull out the same card every time because it’s simpler? Cardback, by Delhi based Orangut Labs, wants to make it easier to maximise the benefits of your cards.

Just check the app before making a purchase, and it will recommend the best card to use. It shows you the reward you’re getting, and you can compare this with the rewards you’ll get for using your other cards as well. Cardback is not involved in the transactions in any way – you feed in the information about the purchase, and it just goes through your list of cards to find the one with the best deals available. This doesn’t require any information about your card either, so there’s no safety concern.

Instead, you just add cards by selecting the bank and the card type and then Cardback checks what deals the banks are offering for these particular cards, to see what will give you the biggest reward.

Currently, the app has retailer information for Delhi-NCR, Mumbai, and Bengaluru. It has support for over 600 different cards, which includes credit, debit, prepaid and royalty cards across 10 major banks and providers. It also supports Paytm mobile wallets. Since the app doesn’t take any information from you other than the name of the bank and the type of card you’re using, it is also safe to use.

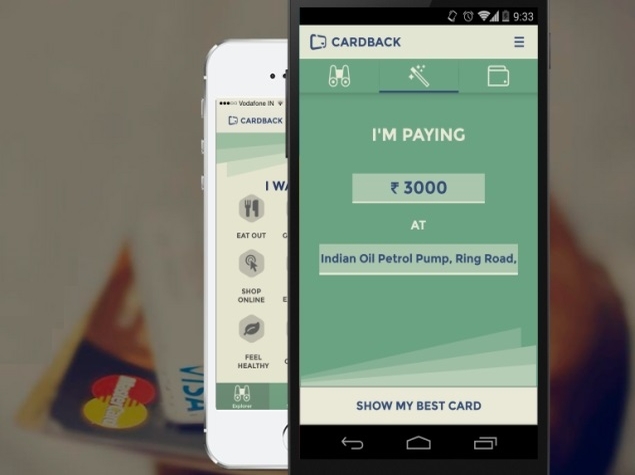

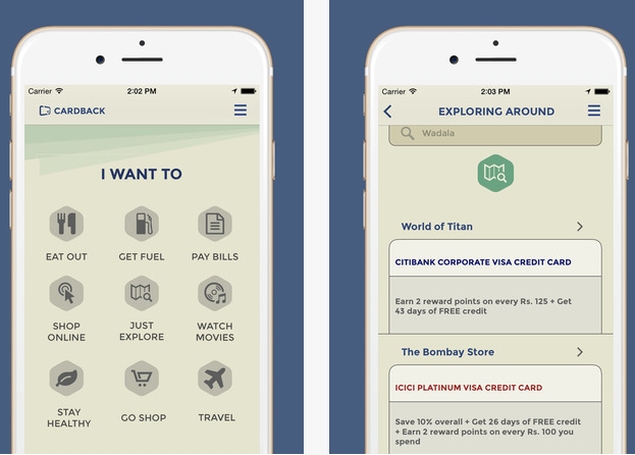

The interface is clutter free – there are three subheads you can tap on, which are all neatly designed. These are Explorer (to find deals in nearby shops by category), Smartpay (to check a payment), and Cardholder (where you can add your cards).

On the Smart Pay screen, you just enter the amount you wish to spend, and then enter the name of the merchant. It will search nearby merchants and show you a drop down list to tap on. Then, click done and it will display the best card, and the offer available on it. You can tap on the button under this to see the rewards on your other cards as well.

Over the course of a few days, we used the app to check before making payments to Foodpanda, at Big Bazaar, and at a petrol pump. Only the first payment was online, and that’s where the app was most convenient to use. That’s because it takes a little time to start up, and if you’re holding up a queue in a petrol pump while you decide which card to use for a payment, then Cardback is too slow to use. In real world situations, you should figure out the card to use before you get in line to pay.

In the Explorer section you can select between nine categories including dining, fuel, utility bills and you’ll see a list of nearby merchants, along with the best card and offer available. In the Cardholder section, you can add cards or see the savings you’ve built up on each card since you started using the app. The app can also send notifications based on your location information with information on the offers running nearby, and the best card to use for them.

While the app’s design is simple and easy to follow for the most part, the Explorer screen starts the categories grid right under the subheads, covering up the top three icons for eating out, shopping and travel. The rest of the design doesn’t have any issues.

There are a couple of issues with the way the app works as well. For one thing, it requires a huge number of permissions – the reasons for these are all explained and are understandable, but it is still something we are not entirely comfortable with. A few more manual inputs, instead of the automatic convenience on offer, might have been worth it for less permissions. The other issue is stability. While the app usually worked, it would hang and crash every now and then, and coupled with the long boot time of the app, this was a major inconvenience.

These caveats aside, we liked Cardback. The design is appealing, and the app is intuitive. The problem it solves isn’t a huge one, but if you can save a little money by using a free app, then why not?

Cardback is free, and available on iOS, Android and Windows Phone.